Net Asset Value Formula (Table of Contents)

- Formula

- Examples

- Calculator

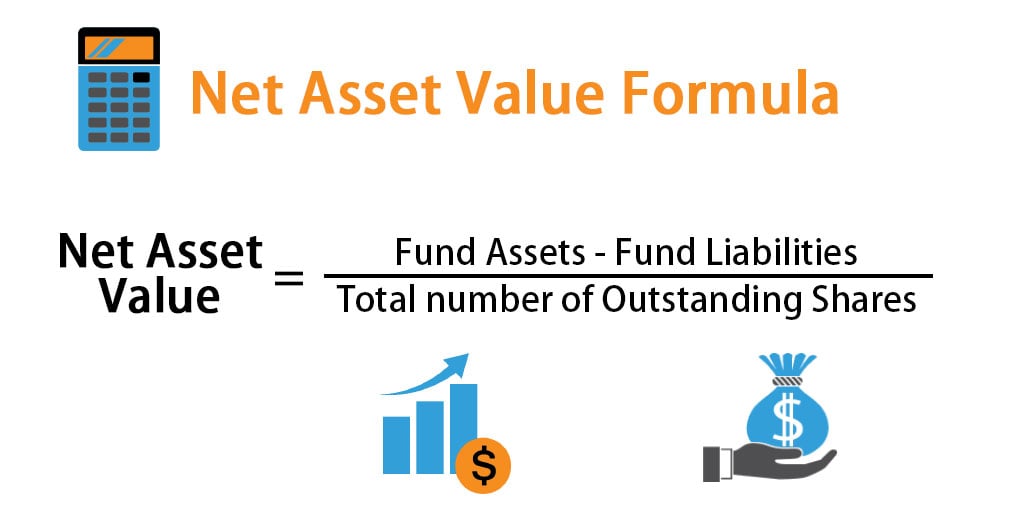

What is Net Asset Value Formula?

In the parlance of mutual funds or exchange-traded funds, the term “net asset value” refers to the price at which each unit is traded (either purchased or sold), and it is a very important metric that is tracked on a daily basis. The formula for net asset value can be derived by deducting all the liabilities from the available assets of the fund, and then the result is divided by the total number of outstanding units or shares.

Formula is represented as:

Examples of Net Asset Value Formula (With Excel Template)

Let’s take an example to understand the calculation in a better manner.

Net Asset Value Formula – Example #1

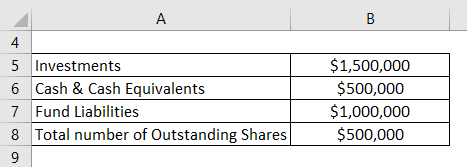

Let us take the example of a mutual fund that closed the trading day today with total investments worth $1,500,000 and cash & cash equivalents of $500,000, while the liabilities of stood at $1,000,000 at the close of the day. Determine the net asset value of the fund today if the total number of outstanding shares is 500,000.

Solution:

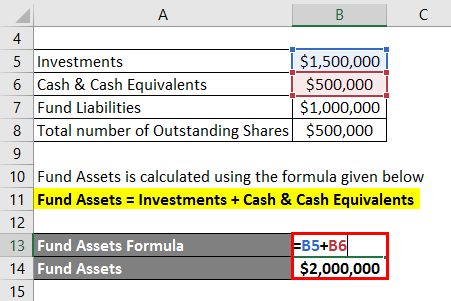

Fund Assets is calculated using the formula given below.

Fund Assets = Investments + Cash & Cash Equivalents

- Fund Assets = $1,500,000 + $500,000

- Fund Assets = $2,000,000

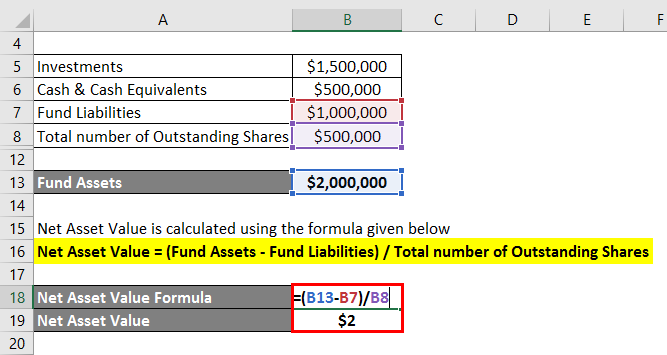

Net Asset Value is calculated using the formula given below.

Net Asset Value = (Fund Assets – Fund Liabilities) / Total number of Outstanding Shares

- Net Asset Value = ($2,000,000 – $1,000,000) / 500,000

- Net Asset Value = $2 per share

Therefore, the Net Asset Value of the fund stood at $2 per share at the close of the day.

Net Asset Value Formula – Example #2

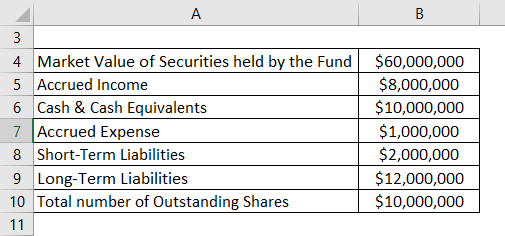

Let us take the example of an investment firm that manages a larger mutual fund. At the end of the day, the following information is available for the mutual fund. Calculate the net asset value.

Solution:

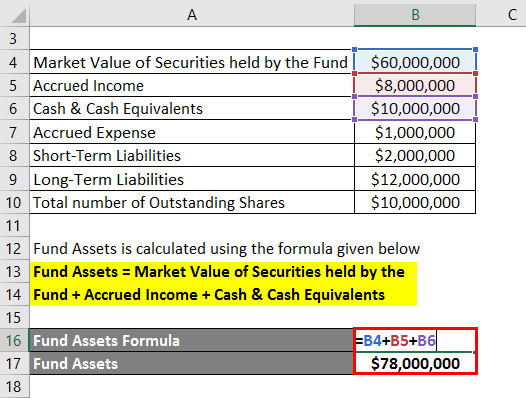

Fund Assets is calculated using the formula given below.

Fund Assets = Market Value of Securities held by the Fund + Accrued Income + Cash & Cash Equivalents

- Fund Assets = $60,000,000 + $8,000,000 + $10,000,000

- Fund Assets = $78,000,000

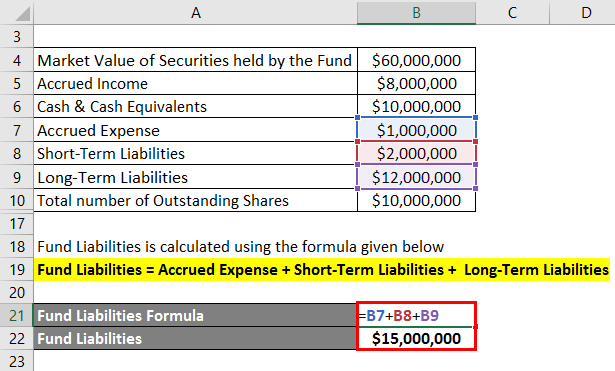

Fund Liabilities is calculated using the formula given below:

Fund Liabilities = Accrued Expense + Short-Term Liabilities + Long-Term Liabilities

- Fund Liabilities = $1,000,000 + $2,000,000 + $12,000,000

- Fund Liabilities = $15,000,000

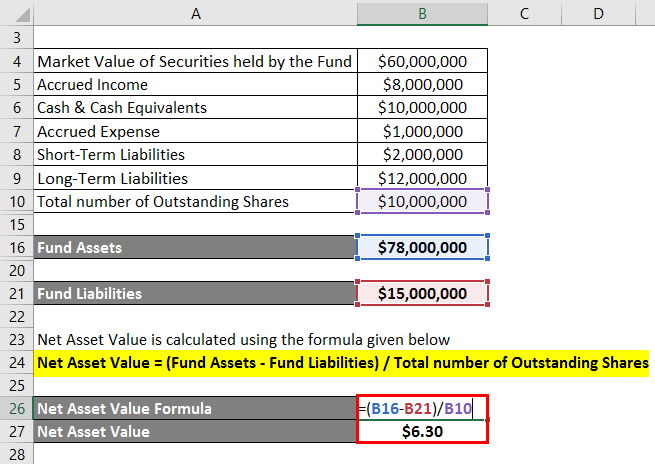

Net Asset Value is calculated using the formula given below:

Net Asset Value = (Fund Assets – Fund Liabilities) / Total number of Outstanding Shares

- Net Asset Value = ($78,000,000 – $15,000,000) / 10,000,000

- Net Asset Value = $6.30 per share

Therefore, the net asset value of the fund is $6.30 per share.

Net Asset Value Formula- Example #3

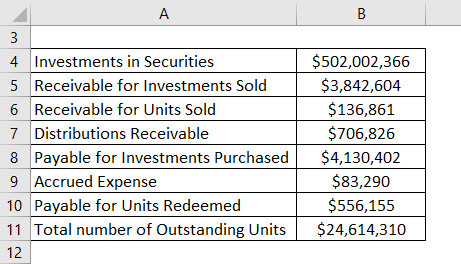

Let us take the live example of Fidelity Investments’ managed mutual fund named U.Fund College Portfolio as of June 30, 2018. The following information is available for the mutual fund. Calculate the net asset value.

Solution:

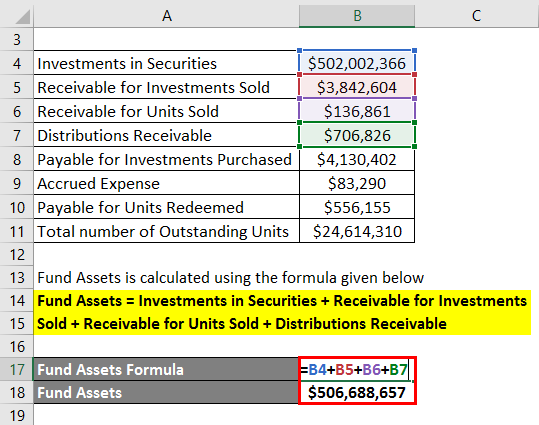

Fund Assets is calculated using the formula given below.

Fund Assets = Investments in Securities + Receivable for Investments Sold + Receivable for Units Sold + Distributions Receivable

- Fund Assets = $502,002,366 + $3,842,604 + $136,861 + $706,826

- Fund Assets = $506,688,657

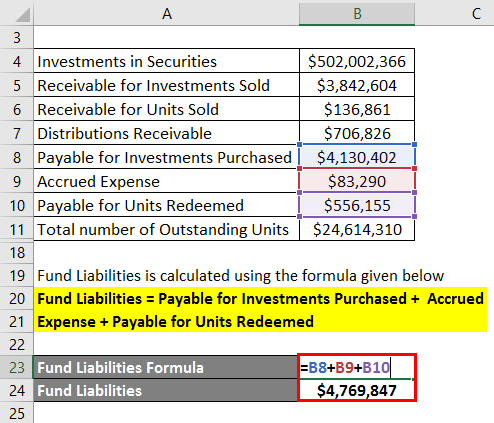

Fund Liabilities is calculated using the formula given below.

Fund Liabilities = Payable for Investments Purchased + Accrued Expense + Payable for Units Redeemed.

- Fund Liabilities = $4,130,402 + $83,290 + $556,155

- Fund Liabilities = $4,769,847

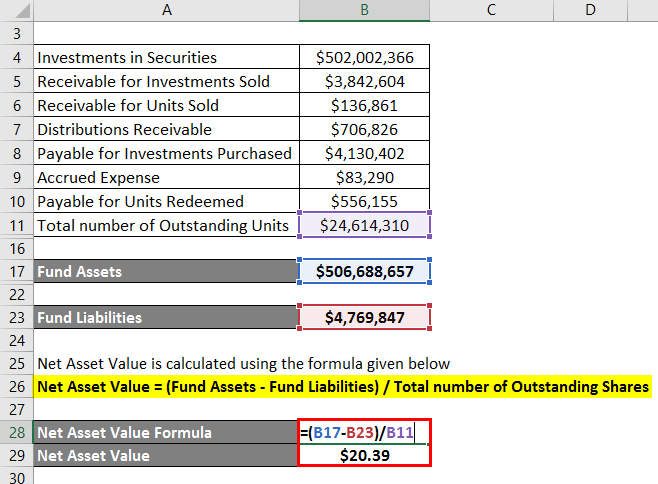

Net Asset Value is calculated using the formula given below

Net Asset Value = (Fund Assets – Fund Liabilities) / Total number of Outstanding Shares

- Net Asset Value = ($506,688,657 – $4,769,847) / 24,614,310

- Net Asset Value = $20.39 per share

Therefore, the net asset value of U.Fund College Portfolio stood at $20.39 per share as of June 30, 2018.

Explanation

The formula for Net Asset Value can be derived by using the following steps:

Step 1: Firstly, determine the total assets of the fund house, and examples of such assets can be investments, cash & cash equivalents, marketable securities, receivables, etc.

Step 2: Next, determine the total liabilities of the fund house, and examples of such liabilities can be debt, accrued expense, etc.

Step 3: Next, determine the total number of outstanding shares of the fund available in the market.

Step 4: Finally, the net asset value can be derived by deducting the liabilities of the fund (step 2) from the assets of the fund (step 1) and then the result is divided by the total number of outstanding shares (step 3) as shown below.

Net Asset Value = (Fund assets – Fund liabilities) / Total number of outstanding shares

Relevance and Use

From the perspective of both mutual fund analysts and investors, it is important to understand the concept of net asset value because it is the book value of a mutual fund. The net asset value of a mutual fund is also analogous to the market price of a stock, and as such, it helps in the comparison of the fund with other mutual funds or the industry benchmark.

Net Asset Value Formula Calculator

You can use the following Net Asset Value Formula Calculator

Recommended Articles

This is a guide to Net Asset Value Formula. Here we discuss how to calculate Net Asset Value along with practical examples. We also provide a Net Asset Value calculator with a downloadable excel template. You may also look at the following articles to learn more –

- Formula for Internal Growth Rate

- Calculation of Effective Tax Rate

- Examples of Correlation Formula

- Complete Guide to Coverage Ratio